Public Employees’ Retirement System (PERS)

Phase I

To begin the retirement process, a Pre-Application for Service Retirement Benefits is to be completed 3-4 months prior to retirement date. The retirement date is set no earlier than the first of the month following termination from employment. The retiree should have their beneficiary’s social security number and date of birth, and a copy of their birth certificate.

Phase II

Once the Pre-Application for Service Retirement Benefits is completed and mailed to PERS, a benefit analyst will conduct an audit on the retirement account and prepare an estimate of benefits. This process may take several months. Once the audit is complete, PERS will mail the retiree a packet of information to complete. The packet will consist of a PERS estimate of benefits, an application for retirement, benefit options and election, information regarding the partial lump sum option (if applicable), direct deposit form, COLA election form, and a federal withholding elections form. State taxes are not withheld from the PERS retirement account. Depending on the benefit option selection, the beneficiary(ies) birth certificate and social security number are to submitted with the PERS paperwork. All completed PERS forms are to be return within 90 days following the effective date of retirement.

Phase III

A retiree may continue health insurance through the plan administrator, Blue Cross Blue Shield of Mississippi (BCBSMS). To be eligible to continue the health insurance, an employee must be participating in the health insurance plan on the day before the effective date of retirement and participate in a retirement plan approved by the Mississippi Public Employees’ Retirement System (PERS). An employee must have participated in the health insurance plan for four years prior to retirement.

Those employees who participant in the Optional Retirement Plan are eligible to retire once the provisions of the ORP account are met. Retirement eligibility is usually 59 1/2 years of age. Employees must be employed four years to be eligible for health and life insurance continuation as a retiree. To begin retirement benefits, the employee must contact the ORP vendor/representative (TIAA, VALIC, VOYA) for information regarding retirement options.

Optional Retirement Plan (ORP)

An employee is eligible to retire once the provisions of the ORP account are met. The age requirement for retirement is usually 59 1/2. The employee may want to contact the ORP vendor/representative (TIAA, Corebridge Financial, VOYA) for information regarding retirement options.

To learn more about retirement options, please click on the vendors below.

Enrollment in Health Insurance

Upon retirement, an employee may apply for retiree health and life insurance through Human Resources. The retiree may continue coverage through the State Health Insurance Plan (Plan) administered by Blue Cross Blue Shield. Life insurance continuation is administered through Minnesota Life Insurance Company. To be eligible to continue coverage, the retiree must be participating in the Plan before the effective date of retirement and have participated in the Plan for four years or more. For more information regarding the State Health Insurance Plan, please visit knowyourbenefits.dfa.ms.gov.

Application for continuation in the State Health Insurance Plan should be completed 31 days before the retirement date to avoid a temporary lapse of coverage. Failure to submit an Application for Coverage form more than 31 days after coverage as an active employee has terminated, the right to continue coverage as a retiree is forfeited. The effective date of retiree coverage will be the first day of the month following termination of coverage as an active employee. Retirement is not a qualifying event; therefore, coverage type changes (Base/Select) cannot be made at this time. In the event retiree health insurance is not elected within 31 days of leaving employment, the retiree may enroll in COBRA coverage during the balance of the COBRA election period. Once the election period expires, the retiree has no option for coverage under the Plan.

The retiree is responsible for paying 100% of the premium for coverage selected for himself and covered dependents. The first month’s premium must be paid when applying. The premium is then deducted from the retiree’s monthly PERS retirement benefit or will be direct billed by BCBMS if the monthly PERS benefit is insufficient to cover the cost of the premium or for employees who participate in the ORP plan . Direct bill participant’s premium payments are due on the first of each month. Automatic bank drafts are also available.

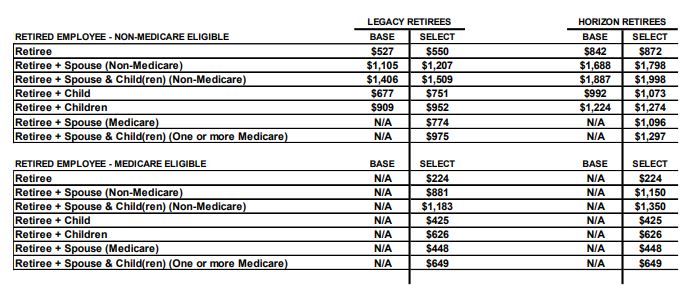

Health Insurance Rates for Non-Medicare and Medicare Eligible Retirees

Health Insurance – Non Medicare Eligible Retirees

The State Health Insurance Plan is the primary payer for a retired employee, who is under the age of 65, is not on Social Security disability, and is not covered as an active employee under another plan.

If you are under age 65, your coverage is identical to that of an active employee. Non-Medicare eligible retirees are either enrolled in Select Coverage or Base Coverage. Coverage options cannot be change at the time of retirement; however, coverage options may be change during the open enrollment period that occurs in October each year.

Health Insurance – Medicare Eligible Retirees

Retirees who are age 65 or older or under the age of 65 with a Social Security disability, are enrolled in the Plan as a Medicare eligible retiree. Medicare is the primary payer for a retired employee and the Plan will provide 100% toward the Medicare deductible and coinsurance amounts not covered by Medicare. Benefits are paid 100% for covered expenses that is not covered by Medicare. Allowed expenses are based on the difference between the Medicare maximum allowable charge and the amount Medicare paid. The Plan only provides benefits for covered expenses outlined in the Plan Document.

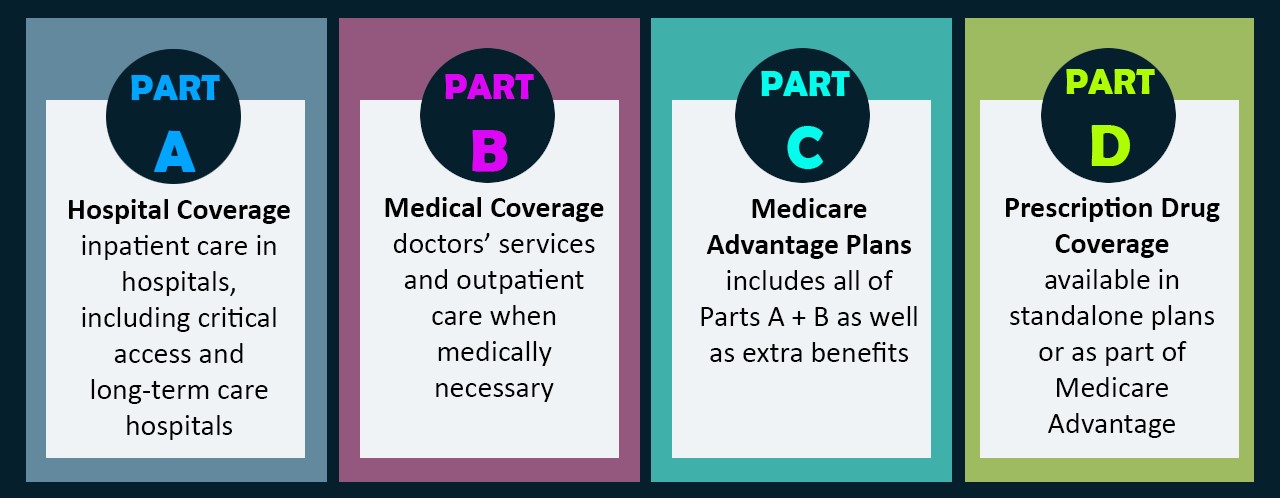

If a retired employee, is eligible for Medicare and does not elect Medicare Part A and B, benefits will be reduced as though Medicare is the primary payer. The Plan will calculate benefits assuming the participant has both Medicare A and B. It is important to enroll in Medicare Parts A, B and D to receive maximum benefits. Once a retiree is approved for Medicare due to Social Security disability, the Plan will update their records to reflect Medicare as the primary coverage effective the date of Medicare eligibility. The Plan will also refund any over payment of premiums and reprocess claims to calculate benefits as secondary to Medicare retroactive to the effective date of Medicare.

Prescription Drug Program

For non-Medicare eligible retirees, the State Health Insurance Plan (BCBSMS) contains prescription drug coverage identical to the same Plan as active member coverage. The Plan does not provide prescription drug coverage for Medicare eligible retirees. Participants must enroll in a Medicare Part D plan to receive prescription drug coverage. Retirees need to ensure that the Medicare Part D coverage is in effect at the time of retirement or when the participant turns 65 years old. An retiree’s pharmacy may be able to assist in finding a Medicare Part D carrier.

REMINDERS:

- If you or your spouse is eligible for Medicare, contact your local Social Security Administration Office to enroll in Medicare Parts A and B. It is important to enroll in Medicare to receive maximum benefits. Even if Medicare is not elected, benefits under the Plan will be reduced as though Medicare is the primary payer. Participants should contact the local Social Security office for information on medical coverage.

- Application for continuation of health insurance is processed through Human Resources one month before retirement.

- Once enrolled as a retiree, all changes must be submitted directly to Blue Cross Blue Shield of MS (BCBSMS).

- Be sure to keep address up to date to ensure that all communications regarding life and health insurance coverage are received.

- Any change in enrollment status, such as death, divorce, entitlement to Medicare, etc., should be reported to BCBSMS as soon as possible.

- Application for Coverage form may be obtained from BCBSMS.

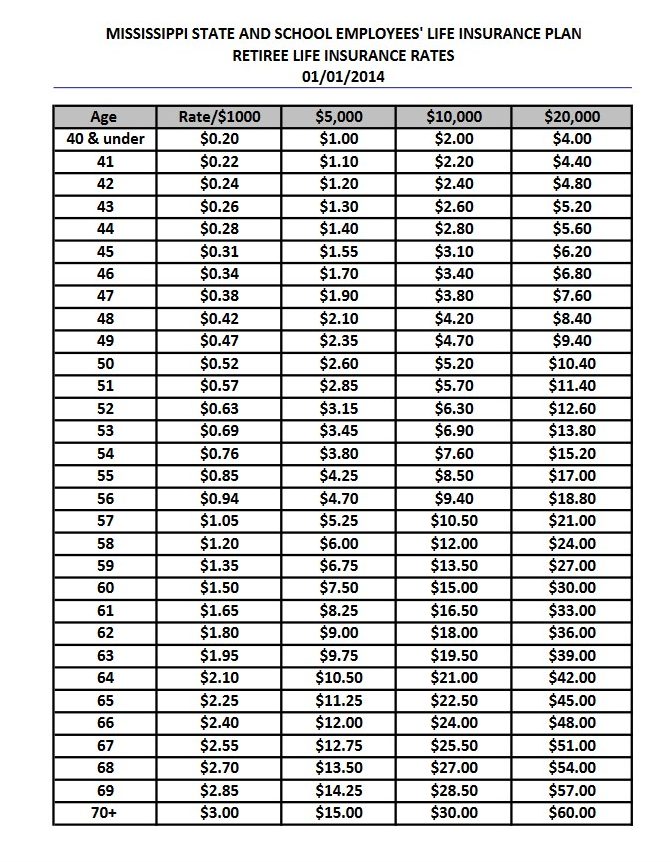

Life Insurance

Upon retirement, an employee may continue a portion of the State Life Insurance, administered by Minnesota Life Insurance Company. The employee must currently have the State of Mississippi life insurance program. Application is made through the HR department. The amounts eligible to continue through retirement are $5,000, $10,000 or $20,000. The cost will depend on age at the time of retirement, and premiums will increase each year until age 70. The retiree must apply at least 31 days before retirement, but no later than 31 days after losing coverage, and must pay the first month’s premium when applying. Late retiree applications will not be accepted. The retiree may also be eligible to port some or all of the coverage had as an active employee.

Retiree Life Insurance Rates

Ancillary Benefits

Most ancillary benefits are available to continue through retirement. Premiums are 100% retiree paid and are bank drafted. In order to continue ancillary benefits, a retiree must be currently enrolled in the ancillary plan. Benefits and premiums for ancillary benefits are the same as an active employee. Application for these benefits can be made through Human Resources.

QUESTIONS?

You can contact Delta State University Human Resources’ Office at 1-662-846-4035 between the hours of 8am – 5pm, Monday – Friday.